Lowest Property prices in Spain after Covid: Prices expected to go up.

There are many indicators, that house prices in Spain have reach their bottom and will go up soon. At least, in many segments and for internal buyers.

In this article I can explain the SIX REASONS.

Covid had its effect. Everywhere. Also, on the real estate markets around the globe and in Spain. But – contrary to most other countries – in a good way: house prices went down. When the pandemic started, I kept track of the current status and made predictions about what expected to happen in the market:

– April 2020 What Will the Impact of the Corona Virus Be On the Property Market in Spain?

– August 2020: Spanish Property Prices Falling During Covid

– February 2021: Real Estate Trends in Spain in 2021

– July 2021: Is There a New Real Estate Boom in Spain?

In my last article last Summer, I listed some ingredients for a possible ‘real estate boom’ in Spain. Now it’s October and it’s time for a new Real Estate Market update. Because that boom is about to happen. Which makes the conclusion of this article pretty simple for potential buyers: if you want to buy a house in Spain… NOW is more than ever the time! You will save MONEY.

In the past weeks, two of the biggest Spanish real estate and financial media platforms consulted me for an article in which they write about this increase in foreign investments and the upward price pressure:

IDEALISTA (the biggest Spanish real estate website)

EXPANSION (the most read Spanish business newspaper).

So WHY is it NOW the best time to buy a house in Spain? You will save MONEY.

I will summarize it in 6 takeaways.

1. We start to see a shortage of good properties.

To start: what is a good property?

In general, for a city apartment, that’s two bedrooms, one-bathroom, little balcony, elevator, from 2nd floor upwards (more light, less noise), in a building without too much maintenance and if you’re lucky, even nicely decorated. In another business case, a ‘good property’ can also be a house or apartment that needs a full renovation.

For the Costas it’s more about the quality of the house, private space and maybe in a complex with shared facilities (sports, swimming pool,).

The shortage of this type of wanted properties is noticed with some geographical differences in Spain. Typically, Barcelona is the leading indicator for cycles in the real estate market and moves first in terms of market drops or recovers. Then normally Madrid follows, and then the rest of Spain.

In Barcelona, we slowly start to see a shortage of these good properties. There is a strong local demand, and international buyers with more savings, eagerness and emotionality are back and sometimes pay more than the market price.

In the Canary and Balearic Islands, this shortage also happens, with an upward trend of the attached price tag.

We notice it clearly in our daily job as buyer agents: when we see a good property for a customer, it’s all about being fast. Waiting means that house will already be reserved by someone else.

The Spanish real estate figures in the first 6 months of 2021 show why: the 267.000 property transactions in Spain during the first semester of 2021 were the highest since 2008. That number is a lot! Some of the properties that was there the past months is starting to evaporate and high demand + less offer will push prices up (with a delay).

2. Both local and international demand is up and will further increase

The economic outlook for Spain is positive. The Bank of Spain and the European institutions predict a 5-7% GDP increase for 2021 and 2022. That’s good news for local property buyers, and a good sign for banks to give financing.

Internationals, as mentioned before, have found their way back to Spanish property grounds with a different drive and desire. They gathered more savings during the restricted pandemic period and Northies desire – more than ever – sunny destinations. To go on holiday, but nowadays more and more to work remotely too. About 90% of our current customers want a property with the ability to work from ‘home’. That ‘home’ is generally not Spain, but a colder country that they escape to enjoy the sun after work. That used to be for a long weekend, but now we see customers coming several weeks per month.

3. A widened gap between prices in Spain and many other countries

After Covid hit, property prices went up in a lot of countries. Worldwide and in Europe. But in Spain they dropped.

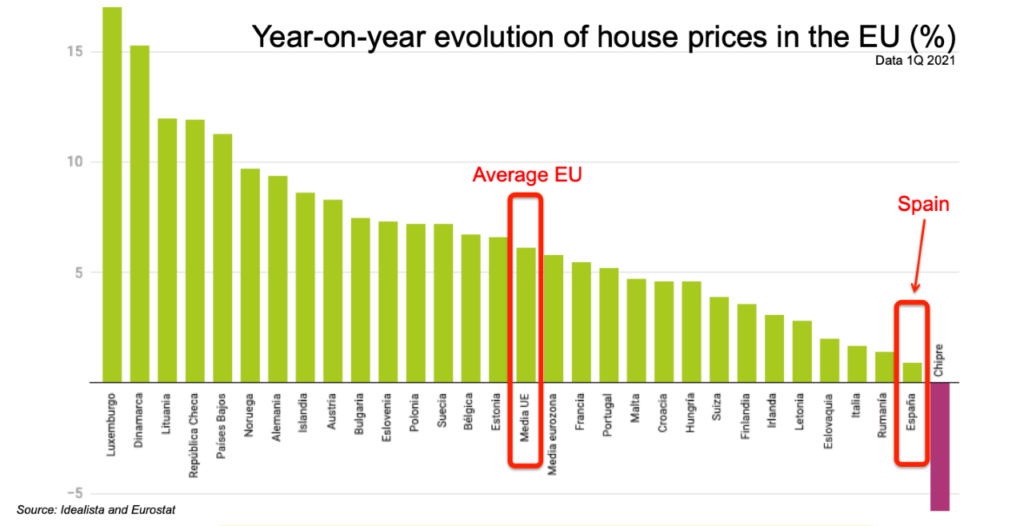

Idealista and Eurostat recently published a graph with the year-on-year evolution of the house prices in the EU, per country. Spain turned out to be the second last country in that ranking (before only Cyprus). The graph shows asking prices; as explained in previous articles, actual deal prices in Spain are lower and average prices have dropped.

At first sight, a 10% house price decrease in Spain might not seem a lot. But if you know prices in your own country go up by – let’s say – 10%, that price difference goes up to 20%. Apply that to the budget of a house and we talk about a huge amount of money.

4. Expect price increases for Oct-Dec 2021

During Covid, we saw a wider gap between the asking price (the one you see on eg. Idealista) and the actual deal price. That gap is now closing because the deal price is going up and negotiation potential is fading.

But not everywhere and at the same time and magnitude. Small beach towns like Sitges with greater local and international demand, see those price increases more significantly, as Barcelona city does.

5. Intenser mortgage wars between banks & different approach

Banks start having a different focus and approach when it comes to approving mortgages:

- More selective monitoring of the industry you’re working in.

You’re active in aviation, tourism, events or hotels? Then chances are big you get it more difficult to get a mortgage. - More checks in your working contract.

You need to justify a stable and recurring income. New jobs and a probation period in the contract are becoming red flags. Even if you keep working for the same international company and get relocated to the Spanish office with a new local contract containing a probation period. - Banks start asking for more guarantees. That can either be putting money in an investment fund, block a certain amount of money on a bank account or take a specific insurance if you loose your job/income. They might even ask you to put another property (with no/less mortage on it) as a guarantee. Or give you more loan if you do.

On a wider scale, we even see a different kind of bank war happening.

Some banks go beyond the 80% LTV (Loan To Value, or the % of the property value they finance) if certain requirements are met. Some banks who were not active in this mortgage race have changes positions in the last weeks.

6. When comparing renting to owning, owning keeps winning in most cases

It’s a recurring real estate dilemma: should I shop renting and start buying my house? I just wrote a more detailed article about that topic and the conclusion is: in almost every case, owning is the better solution.

Let’s make this more tangible with an example.

Imagine you pay 1.000€ rent per month for your rental home. That is 12.000€ per year. For any financial plan or asset, you obviously need to look at a longer horizon. So let’s take 10 years. Then your total rental expenses will be 120.000€ after these 10 years. That is money for your landlord. Gone. To make your landlord wealthier.

Match this now to your income, and you get another perspective.

Let’s take an average of 2.500€ net income per month. Or 30.000€ per year. When you need to pay 1.000€ rent per month for the next 10 years, that means you need to work 4 years of those 10 to pay back your rent. That makes you think: am I doing the right thing here? Because that money is literally gone. It can’t be used for an investment, nor for a downpayment of any mortgage.

Let’s say you have 100.000€ savings. That gives your several options:

- You rent a property of 1.000€/month for the next 8,3 years

- You keep it on your bank account, but recently deposits also start costing you money

- You invest in stock, investment funds, …

- You use it as a deposit to buy a property of 250.000-500.000€ (60-80% LTV) or more (if LTV>80%). Let’s say you use the money to buy a property of 400.000€. Then you can rent it out and receive rent corresponding a 400.000€ property, or sell it with the profit, that a 400.000€ property might give you.

The lever of this option is much bigger than the other options.

It’s clear there are things happening in the market now that could make the message of my next article like: “sorry, you’re too late”. So, I can’t stress it enough for serious future buyers: get started now before it’s too late. We’re at the tipping point of the curve and if you wait too long and doubt too much, you might miss the opportunity to get a really good deal.

Who buys in the next months, will SAVE a lot of money.

Stay an Informed Player

If you want to be well-versed, save money, avoid disturbances and conflicts of interest, this is what you can do:

* Join our Real Estate Series with 2-monthly webinars offering no-nonsense insights and tips to make better decisions and avoid mistakes. Check the top of this blog page for the lastest info & links to register for the next episodes, all for free.

* Contact me to discuss your plans and receive my recommendations (first consultation is free): raf@inspireapartments.com.